Illinois Bonus Depreciation 2024. Illinois decouples from the 100% federal bonus depreciation for all taxpayers starting with tax years ending on or after dec. 7024, the tax relief for american families and workers act of 2024, which includes 100% bonus.

Revival of franchise tax regime. Taxpayers claiming a bonus depreciation subtraction adjustment must:

In 2024, The Bonus Depreciation Rate Will.

When you acquire equipment for your business, you can deduct up to $1,220,000 using section 179 in 2024.

Lower Deductions, Higher Tax Bills.

Beginning in 2023, the amount of bonus depreciation decreases by 20% each year until it phases out totally beginning in 2027.

7024, The “Tax Relief For American Families And Workers Act Of 2024,” To The House.

Images References :

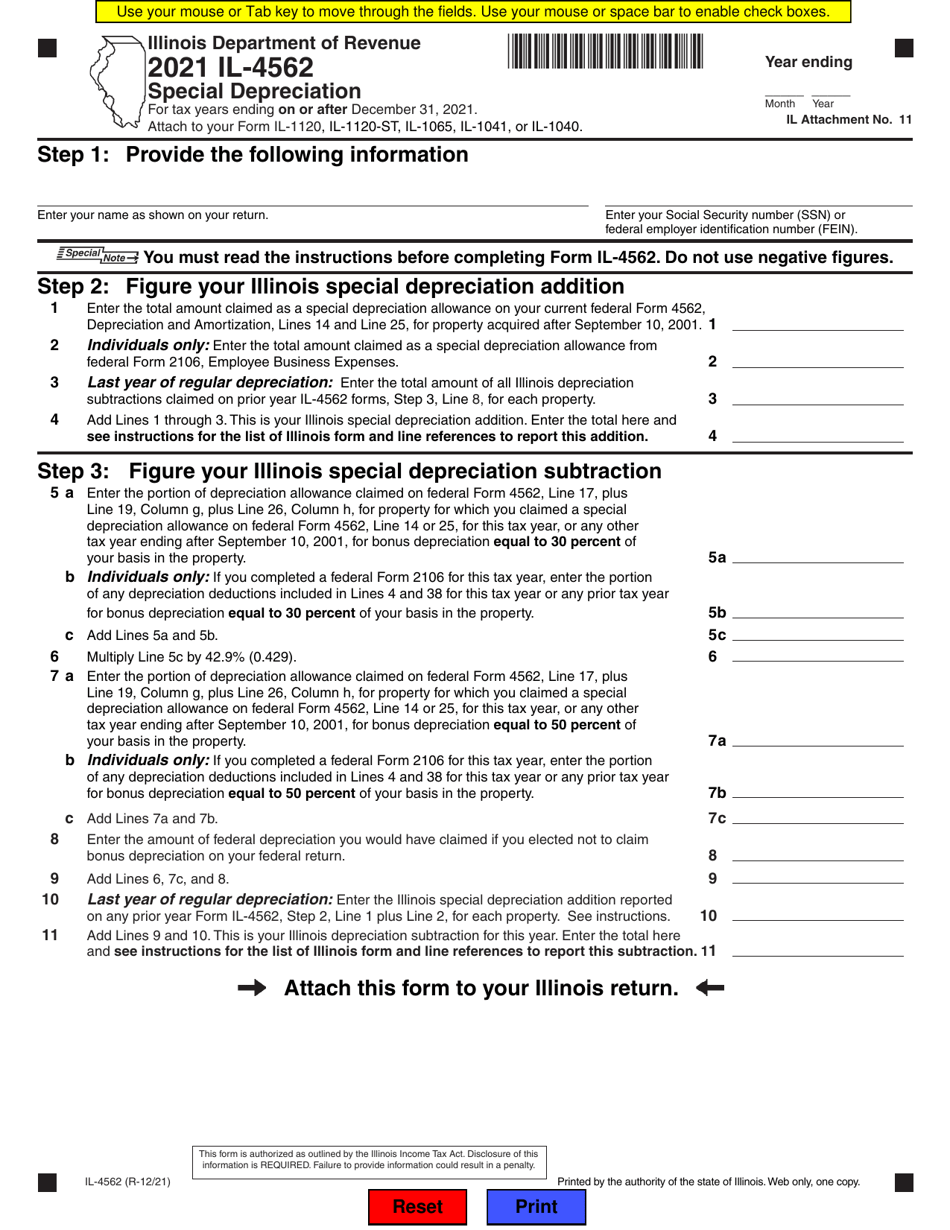

Source: www.templateroller.com

Source: www.templateroller.com

Form IL4562 Download Fillable PDF or Fill Online Special Depreciation, Taxpayers claiming a bonus depreciation subtraction adjustment must: This bulletin summarizes changes for.

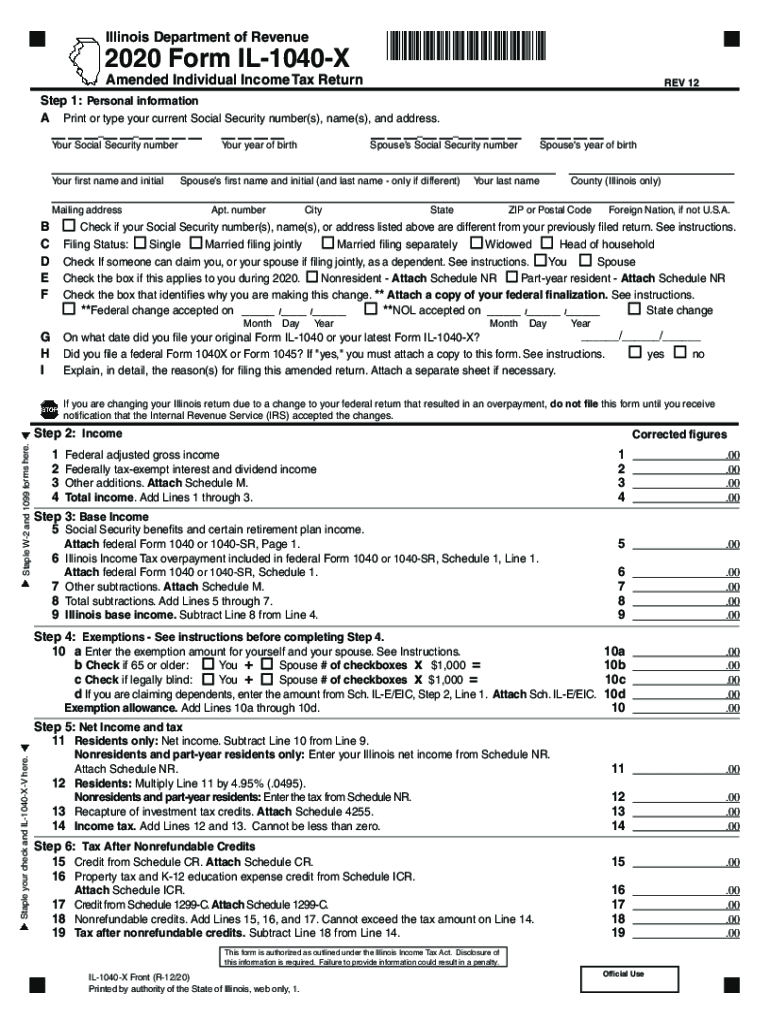

Source: www.signnow.com

Source: www.signnow.com

Illinois 1040 20202024 Form Fill Out and Sign Printable PDF Template, For more information, check out the. Revival of franchise tax regime.

Source: www.educba.com

Source: www.educba.com

Bonus Depreciation Definition, Examples, Characteristics, The deduction phases out when a. In an era where legislative changes shape the economic landscape, the introduction of the “tax.

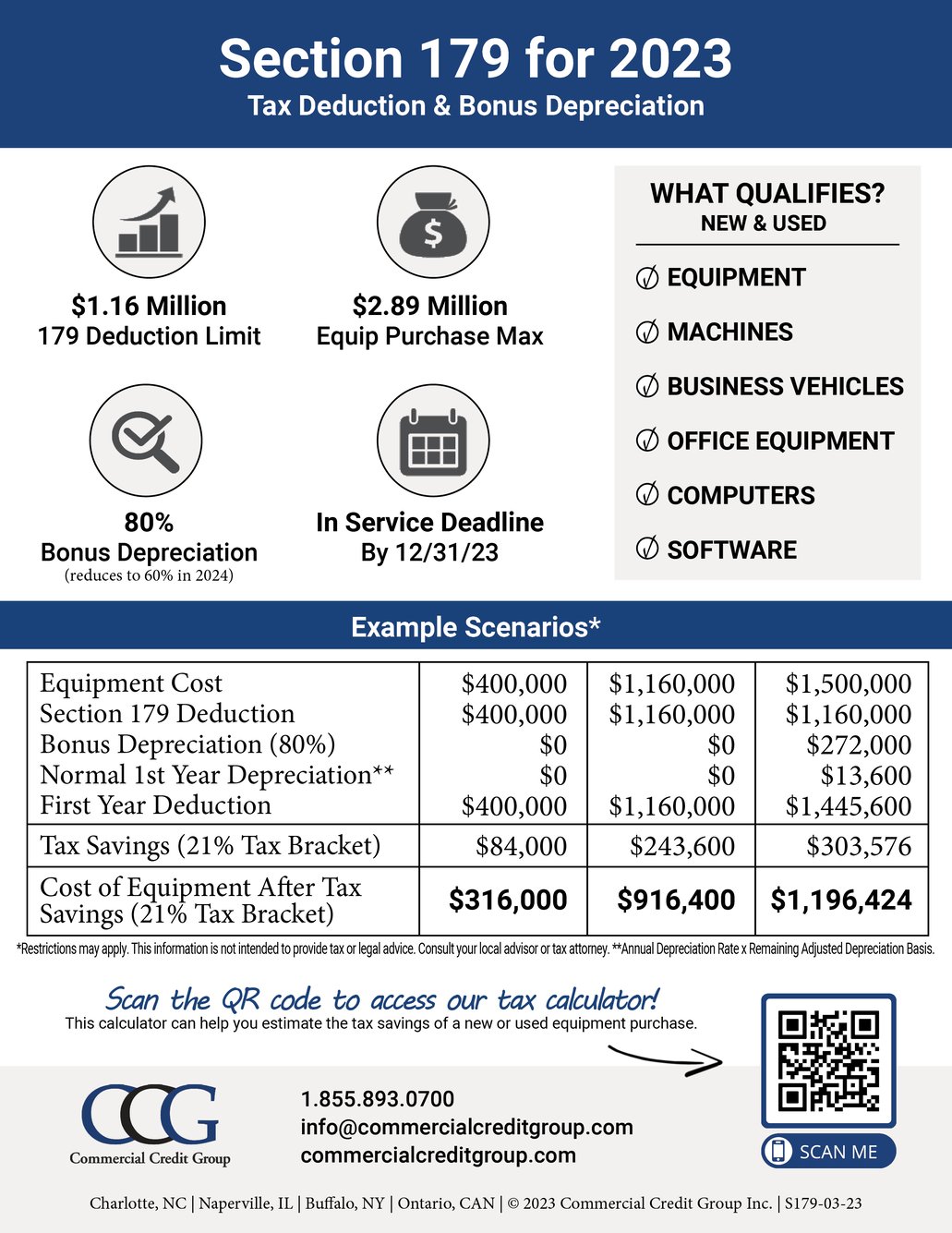

Source: www.commercialcreditgroup.com

Source: www.commercialcreditgroup.com

Section 179 & Bonus Depreciation Saving w/ Business Tax Deductions, This means businesses will be able to write off 60% of. This bulletin summarizes changes for.

Source: sailsojourn.com

Source: sailsojourn.com

8 ways to calculate depreciation in Excel (2023), Hence, xyz is only eligible for an 80% special depreciation allowance of $64,000, but not until its 2023 tax return is filed in early. Understanding the 2024 tax bill’s 100% bonus depreciation.

Source: mavink.com

Source: mavink.com

Depreciation Table Examples, Pritzker signed into law sb2017, the state’s fy 2022 budget legislation. The act amended irc section 168 (k) to allow 100% bonus depreciation for qualified property acquired and placed in service after september.

Source: capstantax.com

Source: capstantax.com

Bonus Depreciation Capstan Tax Strategies, In an era where legislative changes shape the economic landscape, the introduction of the “tax. Understanding the 2024 tax bill’s 100% bonus depreciation.

Source: muzakiraantek.blogspot.com

Source: muzakiraantek.blogspot.com

Calculate depreciation deduction MuzakiraAntek, What's new for illinois income taxes. Bonus depreciation allows taxpayers to deduct a specified percentage of depreciation in the year the qualifying property is placed in service.

Source: corinneanay.blogspot.com

Source: corinneanay.blogspot.com

Allowable depreciation calculator CorinneAnay, For more information, check out the. Beginning in 2023, the amount of bonus depreciation decreases by 20% each year until it phases out totally beginning in 2027.

Source: www.youtube.com

Source: www.youtube.com

PAL 02 How to Estimate Bonus Depreciation on Direct Acquisitions and, Check the box on the taxpayers’ illinois corporate income and replacement return; This means businesses will be able to write off 60% of.

The Full House Passed Late Wednesday By A 357 To 70 Vote H.r.

In 2024, the bonus depreciation rate will.

A Proposed 2025 Budget From The Republican Study Committee — The Largest Conservative Caucus In The U.s.

The deduction phases out when a.